Fixed Income & Bonds

One word: predictability.

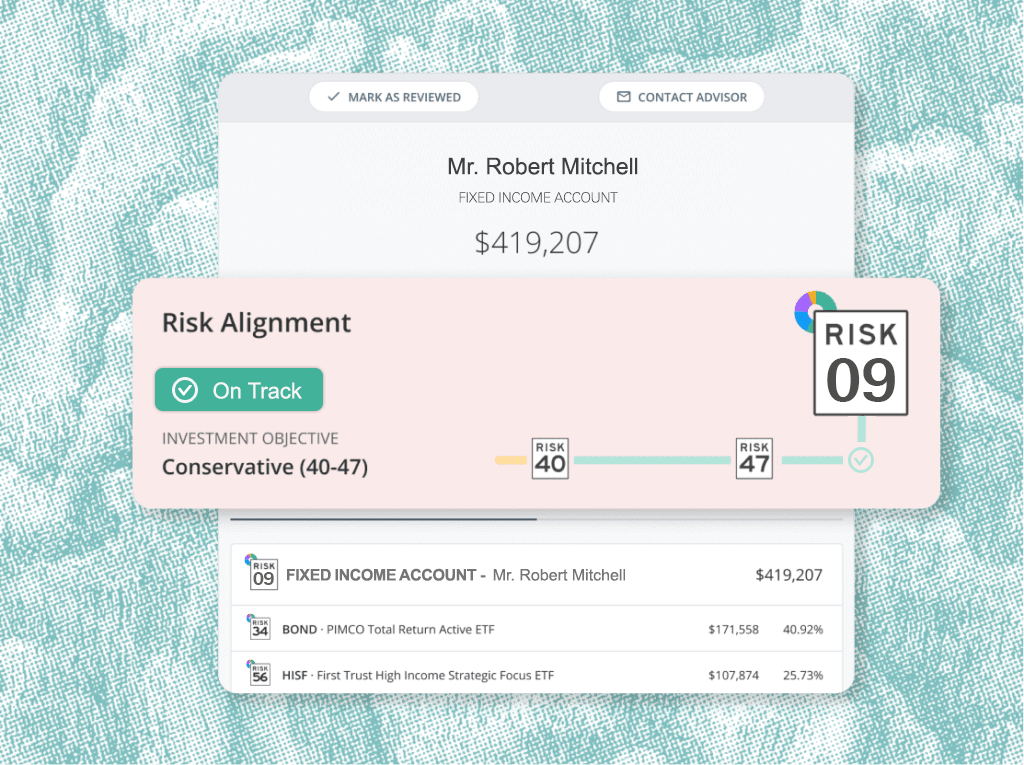

At Linacre Investments, we recognize the importance of stability and income in a well-rounded investment portfolio. Our Fixed Income & Bonds strategy is designed to provide our clients with a reliable income stream, preserve capital, and mitigate risk, even in volatile markets.

Whether you’re seeking a safer haven for your assets or looking to balance your portfolio, our fixed income solutions offer security and steady returns.

Why Invest in Fixed Income?

Fixed income investments, such as bonds, are typically considered lower-risk compared to equities and private equity.

They offer regular interest payments (known as coupon payments) and a fixed repayment of principal upon maturity. This makes them an attractive option for investors looking to generate income, preserve wealth, or reduce portfolio volatility.

At Linacre Investments, we leverage our global expertise to provide clients with access to a wide range of fixed income products.

Our fixed income products

Issued by national governments, these bonds are considered among the safest investments, with minimal default risk.

Offering higher yields than government bonds, corporate bonds are issued by companies seeking capital to grow or expand operations.

Issued by local governments, these bonds often provide tax advantages, making them appealing to certain investors.

Also known as "junk bonds," these offer higher returns but come with greater risk, suitable for investors seeking higher income potential.

Diversified Fixed Income Portfolio

At Linacre Investments, we believe in building diversified fixed income portfolios that balance risk and reward. Our investment professionals carefully select bonds and other fixed income instruments across various sectors, regions, and maturities.

We incorporate both high-quality government and corporate bonds as well as selective exposure to high-yield opportunities. This diversification helps to protect against interest rate fluctuations, credit risk, and other market forces.

Managing Interest Rate Risk

Interest rates play a crucial role in fixed income investing. When interest rates rise, the value of existing bonds can fall, and vice versa.

Linacre Investments expert portfolio managers actively manage your fixed income investments to mitigate interest rate risk, positioning your portfolio to benefit from different rate environments. Whether we anticipate rate hikes or cuts, our strategies are designed to adapt to changing conditions and maximize income while preserving capital.