Stocks and Shares

Discover the potential of investing in stocks and shares with Linacre Investments.

Build a diversified portfolio tailored to your financial goals, with expert guidance and strategies designed for long-term growth and success.

Investment Strategy

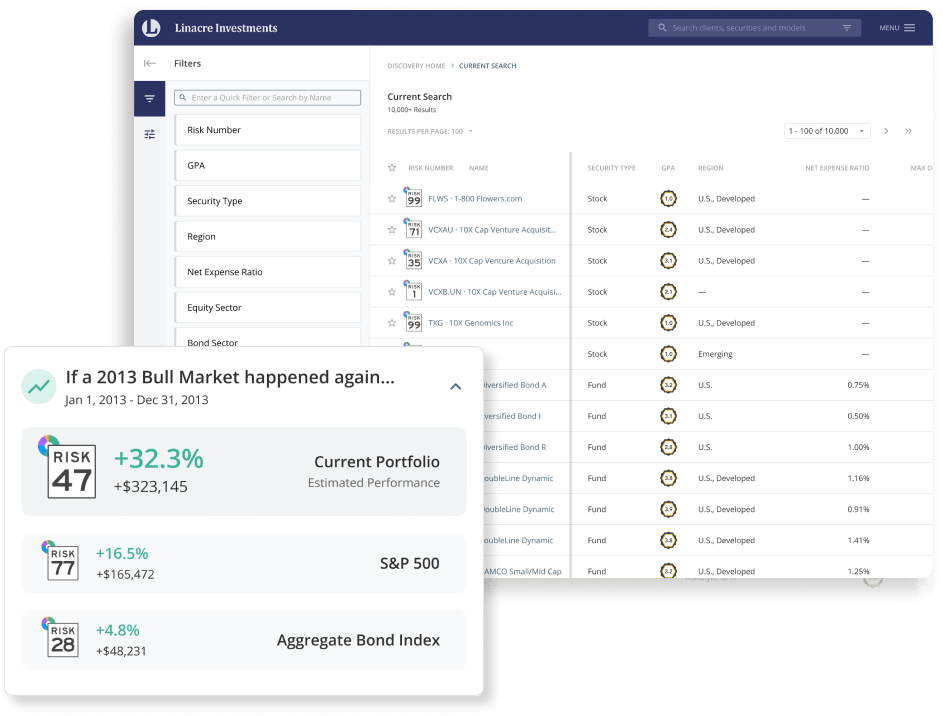

At Linacre Investments, we believe that a well-constructed equities portfolio can be a powerful driver of long-term wealth creation. Our approach to stocks and shares goes beyond traditional investing by focusing on building diversified portfolios that outperform standard index funds.

Building a Diversified Equities Portfolio

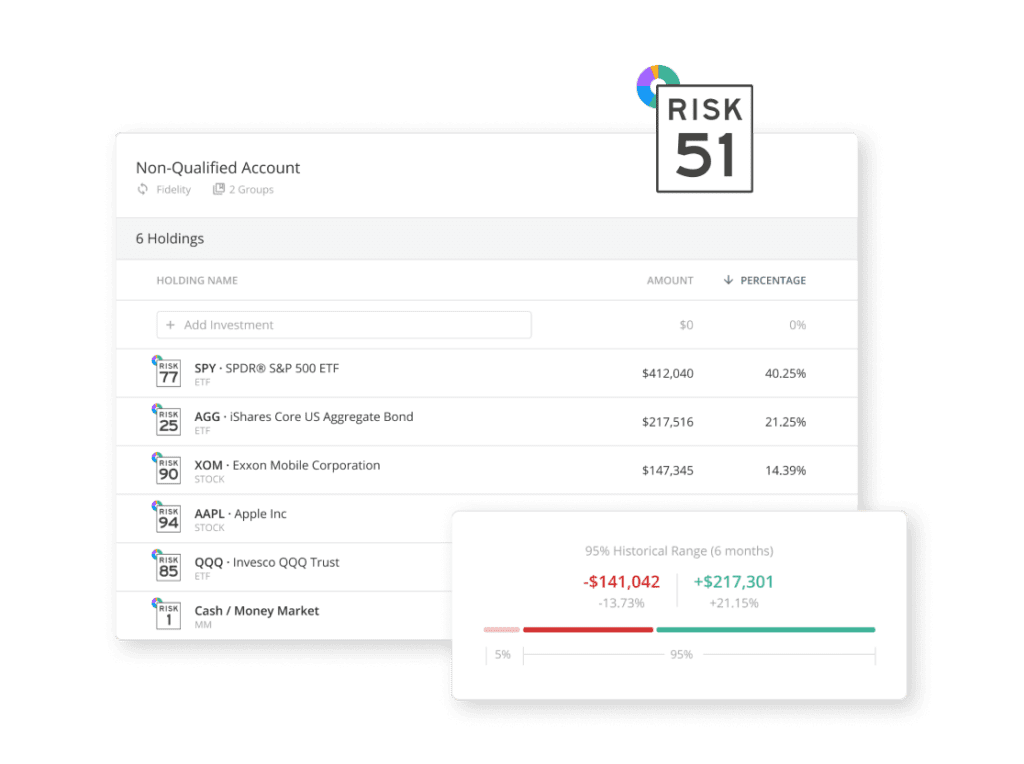

We understand that every client has unique financial goals, risk tolerance, and investment horizons. That's why we take a highly personalized approach to portfolio construction. Our team of experienced portfolio managers carefully curates a mix of global equities, targeting a balance of growth, income, and stability. By investing across different sectors, geographies, and market capitalizations, we aim to reduce risk while maximizing returns.

Our Approach

We understand that the stock market offers a vast array of opportunities, but navigating it successfully requires expertise, insight, and a strategic mindset. Our seasoned investment team leverages decades of experience and deep market knowledge to identify high-potential equities across various sectors and geographies. By focusing on both established market leaders and emerging growth companies, we ensure that our clients' portfolios are well-balanced and positioned for superior returns.

Diversification:

Diversification is at the heart of our investment strategy. We don’t just spread your investments across different stocks; we carefully select equities that complement each other, reducing risk while maximizing potential gains. Our strategy includes:

-

What are stocks and shares?

Stocks (also known as shares or equities) represent ownership in a company. When you purchase a share, you are essentially buying a small portion of that company. The value of your shares can increase or decrease based on the company's performance, market conditions, and other factors.

-

How does investing in stocks work?

Investing in stocks involves purchasing shares of a company with the expectation that their value will rise over time. Investors can make money either through price appreciation (selling shares at a higher price than purchased) or dividends (regular payments from the company to shareholders).

-

What is a diversified equities portfolio?

A diversified equities portfolio is a collection of stocks from various sectors, industries, and geographies. By diversifying, you reduce the risk associated with investing in any single company or market. This strategy helps protect against volatility while providing exposure to a range of growth opportunities.

-

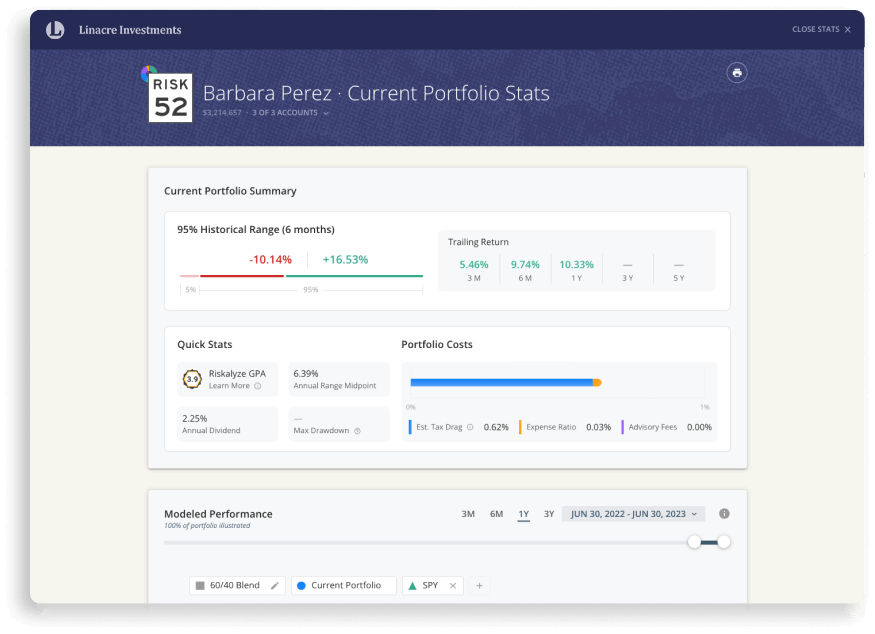

Why choose active management over passive index funds?

While passive index funds provide broad market exposure, active management focuses on outperforming the market through expert selection and timing of individual stocks. At Linacre Investments, our active approach involves thorough research and strategic decision-making to capture opportunities and generate higher returns compared to simply following an index.

-

What are the risks of investing in stocks?

Investing in stocks comes with risks, including market volatility, economic downturns, company-specific issues, and geopolitical events. However, through diversification and active management, Linacre Investments helps mitigate these risks while seeking to maximize your investment potential.

-

What types of stocks does Linacre Investments include in a portfolio?

We invest across a broad range of sectors, market capitalizations, and regions. This includes blue-chip companies, growth stocks, dividend-paying stocks, and emerging market equities. Our focus is on maintaining a balanced mix that aligns with your financial goals and risk tolerance.

-

Can I invest in global stocks with Linacre Investments?

Yes, we provide access to global markets, enabling our clients to invest in stocks from both developed and emerging economies. Our international presence gives us insights into opportunities across various regions, helping to enhance the diversification and potential returns of your portfolio.