Portfolio Risk Assessment

Redefine Risk with Precision

At Linacre Investments, we recognize that risk management is at the core of successful investing. Every investment carries inherent risks, from market volatility to regulatory changes, and our Risk Center is designed to help you navigate these challenges with confidence. We are committed to providing a robust risk management framework that protects your assets while positioning your portfolio for long-term growth.

Our risk management strategy is proactive, systematic, and tailored to each client’s unique needs. We aim to identify, assess, and mitigate risks at every stage of the investment process, ensuring that your portfolio remains resilient in the face of uncertainty. Linacre Investments employs a multi-layered approach that encompasses:

-

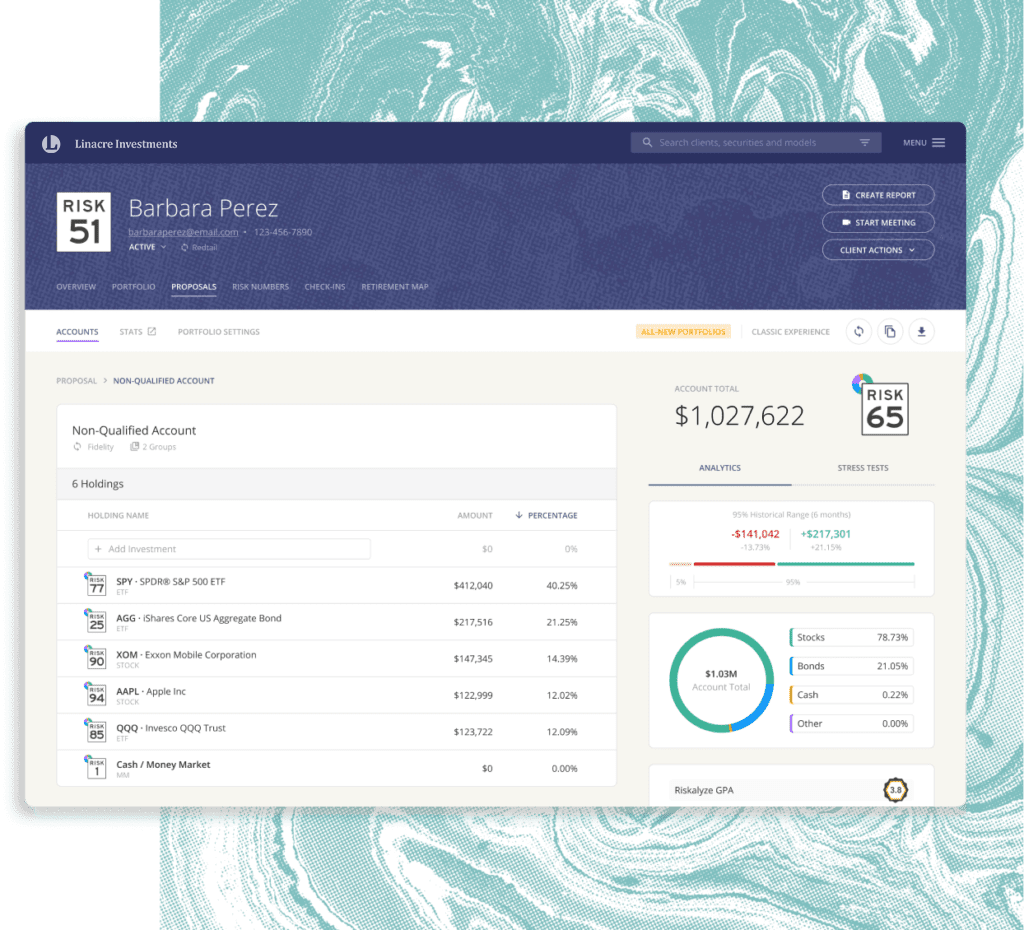

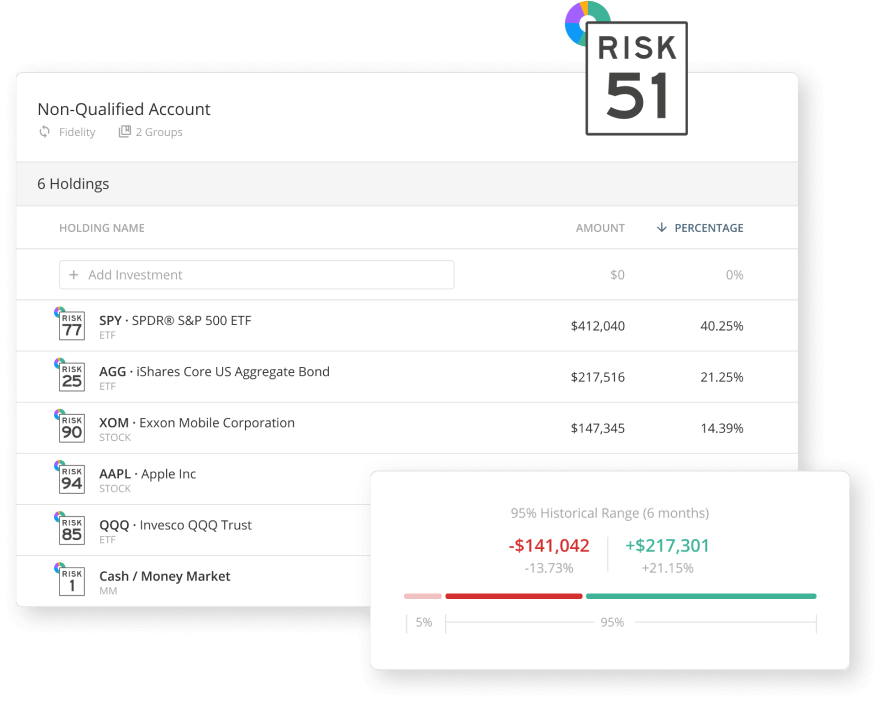

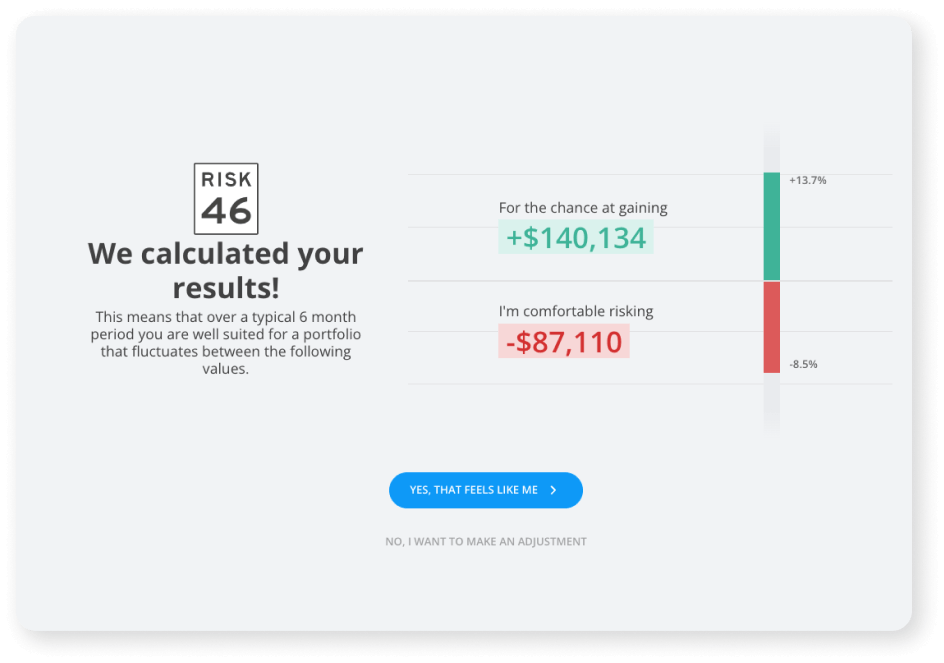

Risk Assessment

We conduct thorough assessments to understand the potential risks of each investment. This includes market risk, credit risk, liquidity risk, geopolitical risk, and more. Our experts continuously evaluate how these factors may impact your portfolio.

-

Diversification

One of the most effective ways to mitigate risk is through diversification. By spreading your investments across different asset classes, sectors, and geographies, we help reduce the impact of any single market event on your overall portfolio. Our diversified strategies are designed to provide stability, even in turbulent markets.

-

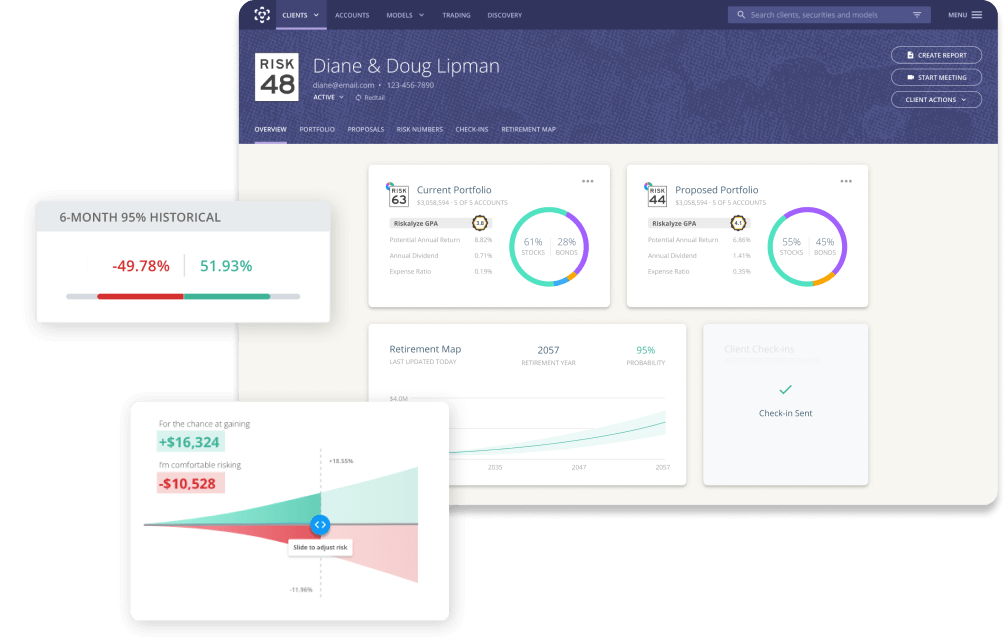

Active Monitoring

Risk is not static; it evolves over time. At Linacre Investments, we actively monitor your investments and make adjustments as necessary. Our team uses advanced tools and real-time data to track market conditions, economic indicators, and potential risks. This allows us to make informed decisions that protect your portfolio and capitalize on emerging opportunities.

Mitigating Specific Risks

Fluctuations in stock and bond markets can significantly impact your portfolio. We manage market risk through diversification, asset allocation, and active management, ensuring that your portfolio is positioned to weather market downturns while capturing upside potential.

Changes in interest rates can affect the value of fixed-income securities. We actively manage interest rate exposure by adjusting the duration of bond portfolios and diversifying across fixed-income instruments.

For investors with global exposure, currency fluctuations can impact returns. We manage currency risk through hedging strategies and diversified exposure to global markets.

Liquidity risk occurs when assets cannot be quickly sold without a significant price concession. We prioritize investing in liquid assets, ensuring that you can access your funds when needed.

Help & support

Whether it's finding out how to manage your account or understanding our charges, Help & support is a quick and convenient way to answer your questions.

Technology-Driven Risk Solutions

At Linacre Investments, we leverage advanced technology to enhance our risk management capabilities. From predictive analytics to automated portfolio monitoring, our tools allow us to identify potential risks before they materialize. This proactive approach enables us to respond quickly to changing market conditions and protect your investments in real-time.

To learn more about our risk management services or to review your current risk profile, contact Linacre Investments today. Together, we can build a resilient, diversified portfolio that adapts to changing market conditions and positions you for long-term success.