Linacre Investments

Managed funds

Our managed funds offer a dynamic way to grow your wealth while benefiting from the expertise of seasoned investment professionals.

Award-Winning Managed Funds from Linacre Investments

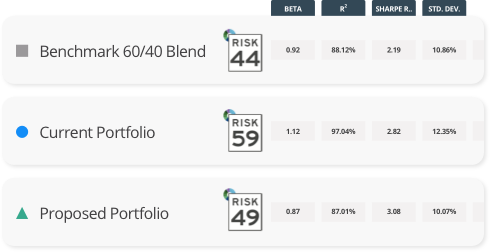

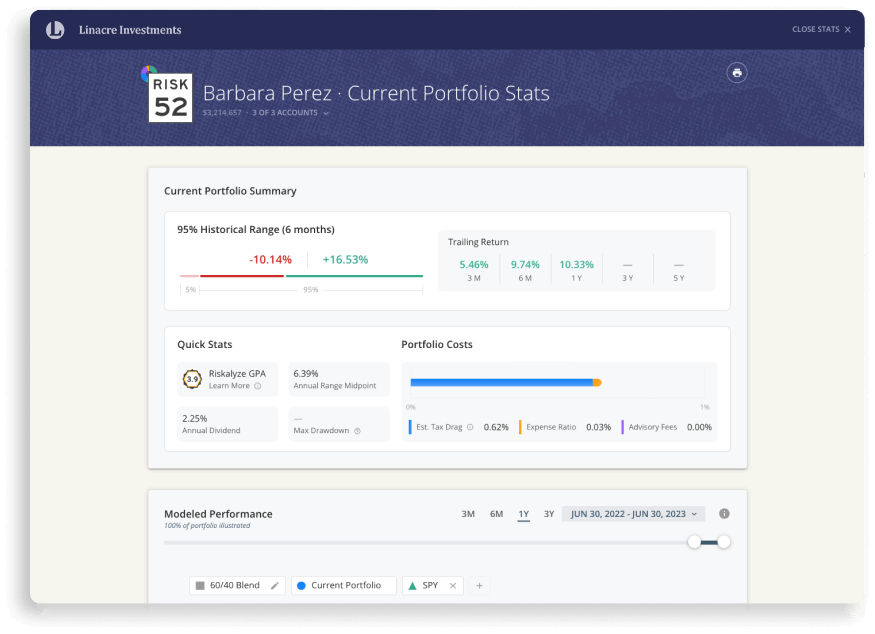

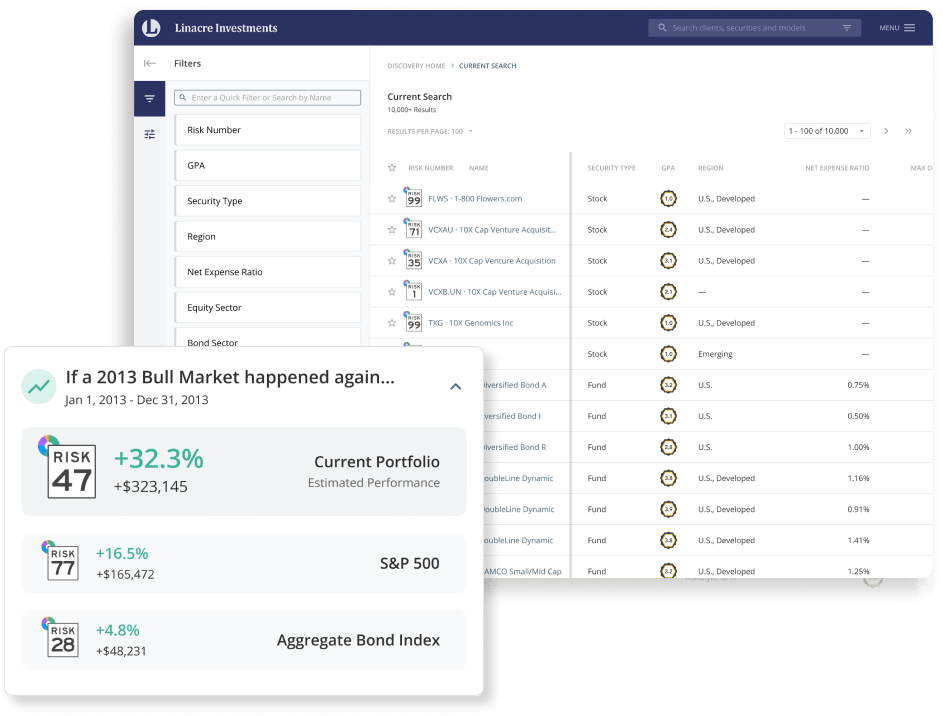

At Linacre Investments, our managed funds offer a convenient and strategic way to grow your wealth with professional oversight. Our team of experienced fund managers actively monitors and adjusts your investments to take advantage of market opportunities while managing risk effectively.

We offer a wide range of managed funds designed to cater to various financial goals and risk appetites. Whether you’re seeking high-growth potential, stable returns, or diversified exposure across multiple asset classes, we have a fund tailored to your needs.

Why Choose Linacre's Managed Funds?

- Expert Management:

Our skilled professionals leverage their market expertise to make informed investment decisions on your behalf. - Diversification:

We provide exposure to a wide range of sectors and markets, reducing risk and increasing growth potential. - Tailored Solutions:

Our managed funds are designed to meet the needs of investors with varying risk tolerances and financial objectives. - Consistent Performance:

With a track record of strong returns, our managed funds help you stay on course to achieve your financial goals.

How to Get Started

Investing in Linacre Investments managed funds is straightforward. Whether you're new to investing or an experienced investor, our team is here to guide you through the process. We start by understanding your financial goals, risk tolerance, and time horizon, then recommend the managed funds that best fit your needs.

Top Performing

Linacre Managed Funds

The Linacre DeFi Dual Direction Fund provides strategic access to Cryptocurrencies in the DeFi asset class. Focused on diversification and risk management, it aims to deliver strong, long-term returns in this evolving sector.

The Short-Term Equity Fund focuses on capitalizing on short-term market opportunities in global equities. With an active trading strategy, the fund seeks to generate high returns by leveraging short term market fluctuations.

The Defensive Income Fund is designed to provide stable returns and preserve capital by investing in high-quality bonds & fixed income products. With a focus on minimizing risk, the fund offers consistent income.

The AI Future Asset Fund targets high-potential private companies with strong growth prospects in the AI sector. Focused on long-term value creation, the fund offers investors early access to high-growth opportunities.

-

What are managed funds?

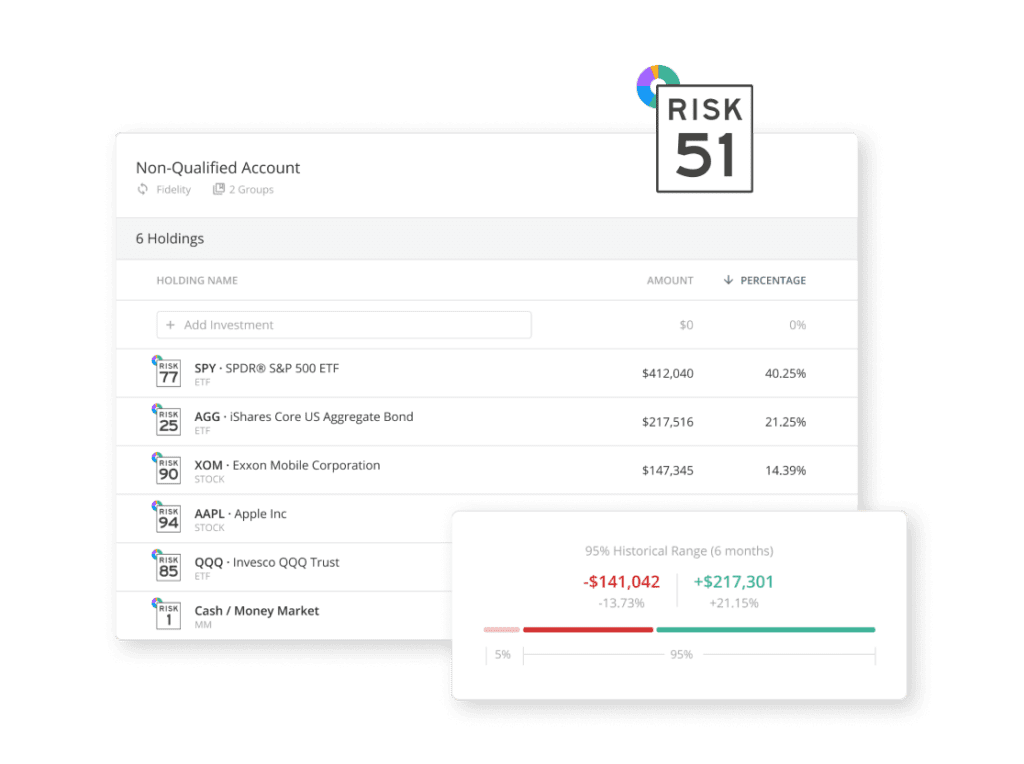

Managed funds are investment vehicles where your money is pooled with that of other investors to invest in a diversified portfolio of assets, such as stocks, bonds, and other securities. These funds are actively managed by professional portfolio managers who make investment decisions on behalf of the fund's investors.

-

How do managed funds work?

When you invest in a managed fund, you purchase units or shares in the fund. The value of these units rises and falls based on the performance of the fund's underlying assets. The portfolio managers handle all aspects of the investment process, including selecting investments, monitoring market trends, and adjusting the portfolio to align with the fund's objectives.

-

How do I choose the right managed fund?

Choosing the right managed fund depends on your financial goals, investment horizon, and risk tolerance. If you're seeking growth, you might consider equity or thematic funds. If you prefer stability and income, fixed income or balanced funds could be a better fit. Our financial advisors can help you select the fund that aligns with your objectives.

-

Are managed funds suitable for long-term or short-term investments?

Managed funds can be suitable for both long-term and short-term investments, depending on the fund’s strategy and your financial goals. Equity and thematic funds are generally better suited for long-term growth, while fixed income or balanced funds might be more appropriate for shorter-term objectives. Your investment horizon will help determine the best option for you.