Mutual Funds and ETFs

ETFs vs. mutual funds: Understand the difference

Exchange-traded funds (ETFs) and mutual funds are both popular investments with some similar characteristics, but also some important differences.

Before we break them down, let's talk about what these funds are:

ETFs and mutual funds are both collections, or “baskets,” of individual stocks, bonds, or other investments—in some cases hundreds of them—all pooled together. When you buy a share of the fund, you own a small piece of this big basket of assets.

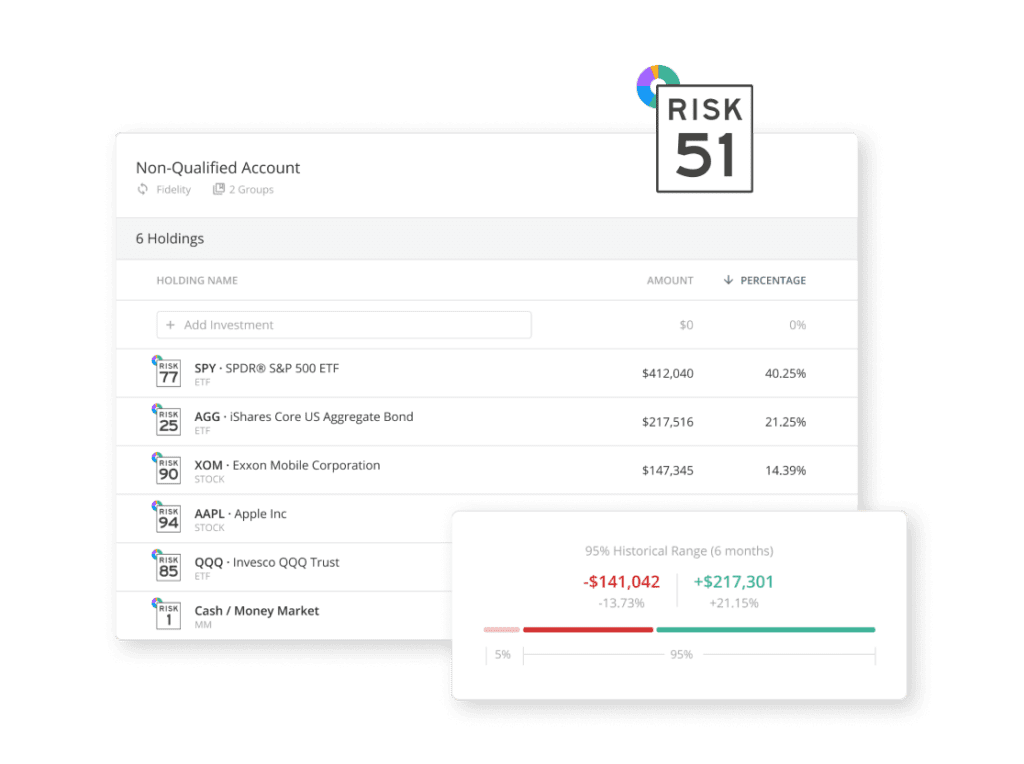

Exchange-Traded Funds

Baskets of individual stocks, bonds, or other investments that may be traded throughout the day, just like stocks.

Prices may go up and down throughout the trading day, and typically have lower costs than actively managed funds.

Typically managed to replicate the performance of a certain index (e.g., NASDAQ 100, S&P 500®, etc.).

ETFs offer trading flexibility as they can be bought or sold throughout the trading day, or as part of more sophisticated trading strategies.

-

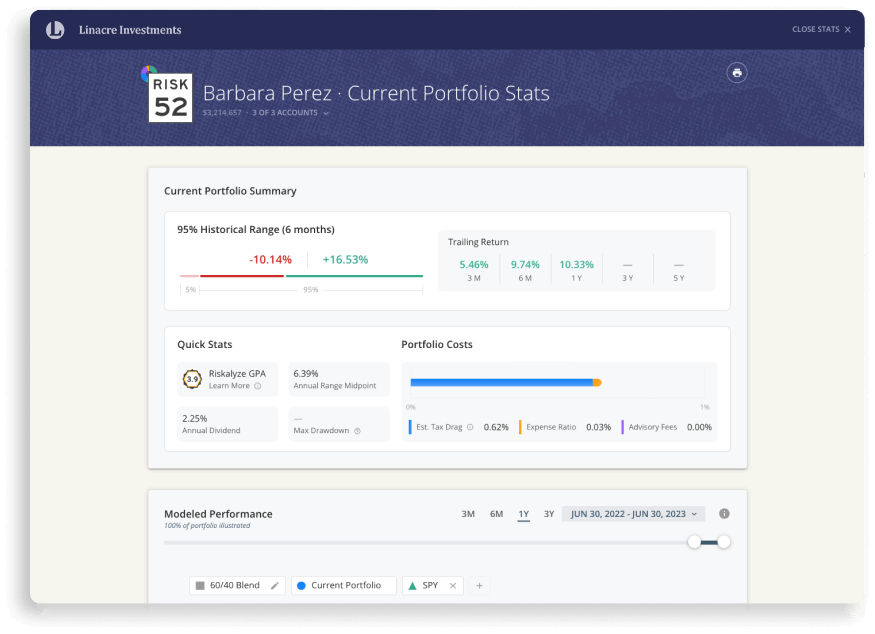

Are typically less risky than buying individual stocks and bonds.

Because ETFs and mutual funds can hold so many different individual investments, there's less chance of an overall portfolio loss if one investment goes bad. In other words, both ETFs and mutual funds typically give you some diversification.

-

Have professional managers who pick the investments, so you don't have to.

Both types of funds are administered by professional portfolio managers who choose and monitor the stocks, bonds, and/or other investments that are in the fund.

-

Give you a very broad range of investment choices.

Among the thousands of ETFs and mutual funds on the market, you can find funds that buy different types of investments (stocks, bonds, and others), or invest in different geographic locations, industries, types and sizes of companies, and much more.

Mutual Funds

Baskets of individual stocks, bonds, or other investments handpicked by a professional fund manager that trade only once per day.

Prices are determined only once each trading day, after markets close.

Typically actively managed by professionals seeking to outperform the market.

Typically offer automatic dividend reinvestment and other convenient deposit and withdrawal features.